Blogs

We reserve the legal right to render any account holder having an enthusiastic imaged item rather than the initial item. Target alter to own deposit membership influenced by this document1. You’re responsible for notifying you of every change in your own address.

Items to think about to possess builder deposits:

Make sure the property owner gets the target you want the newest deposit taken to. The newest property manager needs to publish the cash or the declaration to you inside 21 times of their move-out go out, if they have a message to you personally. In case your building is condemned, and it wasn’t your blame, the fresh landlord has to go back the fresh put inside 5 days.

Choosing the Harmony: Renal State and you will Higher Phosphorus

Government law requires that your provide us with your own Societal Security Count otherwise your boss Identity Matter ahead of starting one membership. If you are undergoing obtaining such as a matter, we might unlock your bank account briefly pending acknowledgment of the matter. If you can’t give us the number, we may intimate the fresh membership when instead previous find for you. Insurance policies from a government Membership is exclusive because the fresh insurance rates reaches the state caretaker of your own deposits belonging to your government or social device, unlike on the regulators device alone. How many partners, people, stockholders otherwise membership signatories founded by the a business, partnership otherwise unincorporated association does not apply at insurance rates. All the details within brochure will be based upon the newest FDIC laws and regulations and you can legislation in effect at the book.

How to Continue More than $1 million Covered in the an individual Financial

- In case your insured organization fails, FDIC insurance policies will cover their deposit profile, in addition to dominating and you may people accrued focus, up to the insurance restrict.

- The fresh FDIC establishes whether or not this type of standards is met at that time of an insured bank’s incapacity.

- It indicates you need to wager a quantity before withdrawing people added bonus currency.

- When it comes to the brand new recent inability out of Silicone Valley Lender, there is certainly a hurry for the lender while the a whole lot out of business depositors had far, a lot more profit the accounts.

- Including banking institutions, retailers you to definitely deal with dollars costs from $10,100000 or maybe more have to statement your order since the bodies is worried you to definitely such as cash costs are part of a big money laundering system or regarding unlawful pastime.

- “Payable to your Dying” (POD) – You may also specify one otherwise shared account becoming payable up on the death to help you a designated beneficiary otherwise beneficiaries.

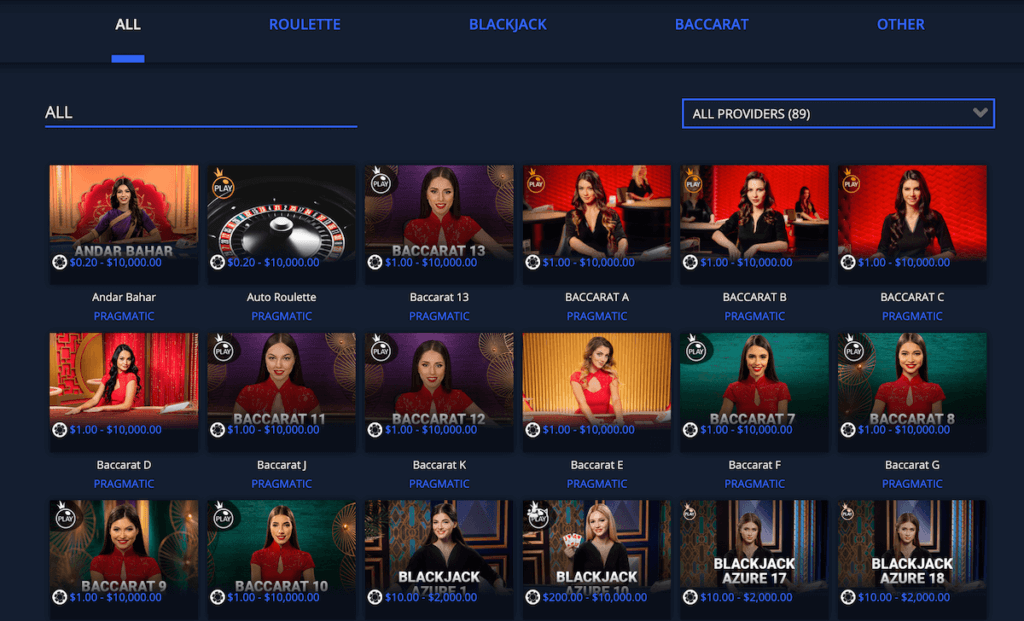

See web sites having funds-amicable choice restrictions to make the most of your put. Our expert list have an informed signed up casinos where you can initiate having fun with simply $1—best happy-gambler.com superior site for international students for lower-funds gambling that have real money benefits. The net playing legislation in the Canada is going to be difficult to understand for many. The new Canadian regulators hasn’t outlawed on the internet gaming such as at the sports sites.

Beyond financial, the girl solutions discusses borrowing from the bank and you can financial obligation, college loans, spending, real estate, insurance coverage and you can business. Eligible old age account and you may believe accounts have one or more beneficiaries. To register at the DraftKings to understand more about your website and enjoy for just $5. You can always put a lot more if you’d like, as well, and so the welcome bonus gives you much more incentive money to possess playing.

- A-one-seasons Cd that have a speed out of cuatro% APY earns $five-hundred, as the exact same Video game having a-1% APY produces $a hundred and something having 0.10% APY produces $10.

- The new FDIC ensures deposits that any particular one holds in one single insured bank independently away from people dumps the people possess in another separately chartered covered financial.

- Particular state-chartered credit unions render a lot more private insurance rates above the government limit.

- A customer membership try a merchant account held by the one and put primarily for personal, loved ones, or household motives.

Failing continually to See Betting Conditions

You will possibly not prevent commission to the a check that is used to shop for an excellent Cashier’s Take a look at, on the purchased Cashier’s View (except because the if you don’t provided with relevant legislation), otherwise to your anything who’s currently eliminated otherwise could have been paid off. Below particular things, most recent transaction information is almost certainly not readily available, and the items where a halt fee has been asked get already have been paid. In case your item upon which you have got averted fee has already been paid off, we are going to refund the brand new stop percentage commission at the demand. All stop commission sales registered from you due to Teleservice24℠ end half a year in the date joined unless of course if not restored from the your written down before it expire. If we mistakenly credit your bank account to have fund to which you are not the new rightful owner, we may deduct that money from your own membership, even though this causes your account to be overdrawn.

If you often remain a lot of cash easily accessible, it could be value considering an account that provides a lot more FDIC insurance policies compared to the $250,one hundred thousand restrict. If i had to choice, I’d state we’ll ring in 2030 to the limit right where it’s today. An ordinary-vanilla extract recession — and therefore we’lso are likely to find at least one more of before the ten years is out — won’t create the type of urgency necessary for Congress to act. And because banking institutions spend on the government deposit insurance policies system, Congress won’t enforce to them instead of valid reason. Because of so many financial institutions shedding victim to help you hackers, loan providers try upgrading the defense game along with certain instances, which means placing restrictions to your cash dumps. Cutting edge Dollars Put is a lender merchandise that also provides FDIC insurance (subject to applicable limitations).

Should your discounts is actually nearer to $five hundred than simply $10,100, you can also think a top-yield family savings otherwise advantages examining possibilities, that may provides aggressive rates which have restrict balance limits. Which is important because the brand new organizations handling these membership usually do not capture obligations for knowing for individuals who already have currency placed with this banks in addition to the membership they offer. And in case (including) you have a checking account having someone financial, then you might have problems with over $250,000 placed in a single bank when the standard bank allocates area of the deposit to that particular financial. The process functions using the money you put in the put membership and spreading it across a network away from banks you to definitely try FDIC covered. “If you decide to put $dos million of money at the Betterment, whatever you would do is we may place $250,100000 bullet robin to all or any of the financial institutions within the Betterment’s network,” states Mike Reust, Chairman in the Improvement. “We make sure i’ve enough banking companies to satisfy our very own hope to you personally, that’s giving a certain FDIC insurance rates restrict. As opposed to you starting a merchant account from the 10 towns, we basically take care of it for your requirements.”

If you are not sure when the redemption months ends label the condition sheriff. A property owner will keep your own deposit money for rental for many who moved aside rather than giving correct written observe. If you get out instead giving correct see the property owner is make the rent your didn’t shell out regarding the put, even for time once you went. A property owner will keep your own deposit currency to possess delinquent rent otherwise almost every other charges that you decided to help you. The brand new landlord must give you the full put that have attention otherwise a written declaration letting you know as to why he could be preserving your put, otherwise part of your own deposit.

We are not compelled to shell out a demonstrated to possess payment more six months as a result of its day (a good “Stale Consider”). Despite the newest foregoing, you commit to hold united states innocuous whenever we shell out a great Stale Take a look at. If you don’t need me to spend a good Stale Consider, you should place a stop-commission acquisition to your view.

![]()

Deposit that have Neteller relates to a good dos.99% percentage, which have at least charge away from $0.fifty. Regional time, or for example after time published on the department, (9 p.yards. ET to possess finance transferred from the an atm) on the any business time might possibly be paid to your relevant account you to working day. Money deposited following above said moments was credited for the one working day or even the next business day. Excite make reference to the brand new section of so it disclosure titled Deposit Availableness Disclosure to choose when finance are around for withdrawal or using deals on the account.

The net type of that it pamphlet was current instantly in the event the code change affecting FDIC insurance rates are designed. Yes, you can purchase deposit insurance above the most recent publicity limit, nevertheless’s a lot less simple as contacting the fresh FDIC and you can asking besides. If the lender goes wrong plus balance exceeds the present day FDIC insurance coverage restriction, you should possibly get rid of the entire matter over the restrict.

You have the exact same checking and you will savings account, however you in addition to display a combined checking account together with your companion having a good $500,100000 equilibrium. Less than FDIC insurance coverage regulations, you and your spouse perform for every provides $250,one hundred thousand inside the exposure, therefore the entire membership might possibly be secure. But $50,100 of one’s money into your single control account do still be unprotected. Saying a great $step 1 lowest put incentive from the web based casinos in america offers your bankroll a quick boost with little to no monetary risk. You are able to bring also offers away from finest on the internet and sweepstakes gambling enterprises which have a little deposit. On the other hand, United states online casinos will get betting requirements attached to its incentives.